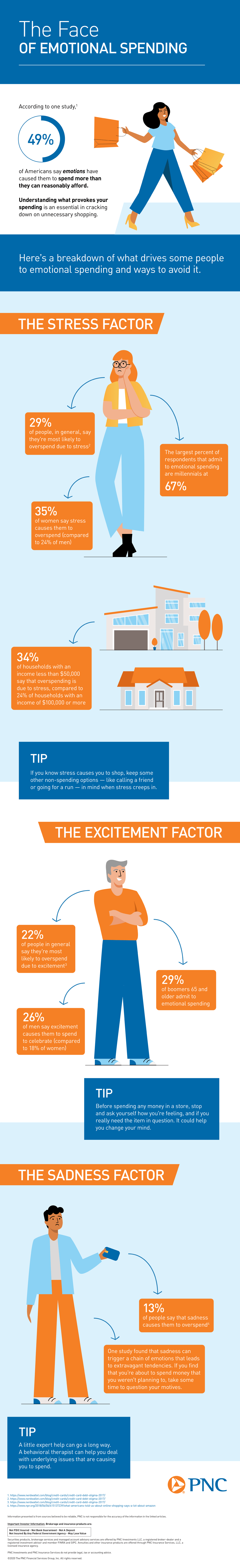

Do you find yourself reaching for your wallet, credit card, or checkbook when emotions run high? If so, you may be one of the many individuals who struggle with emotional spending. Emotional spending is a common problem that can wreak havoc on your finances. Fortunately, there are steps you can take to avoid it. In this article, you’ll learn how to recognize emotional spending and strategies to help you resist it. Read on to learn how to maintain financial discipline and avoid the pitfalls of emotional spending.

Set a budget limit

.Setting a budget limit is essential to avoiding emotional spending. By setting a limit, you can gain control and prevent yourself from impulsively buying unnecessary items. Make sure to regularly review your budget and stick to it!

When it comes to emotional spending, it’s important to be mindful of what you’re buying. Avoid purchasing items you don’t need just because you’re feeling down. Instead, find healthier ways to cope, such as taking a walk, talking to a friend, or writing in a journal.

Track spending habits

Tracking your spending habits is an important step in avoiding emotional spending. Make sure to note all of your purchases, no matter how small, so you can see where your money is going and how you can better manage it.

When it comes to avoiding emotional spending, it’s important to stay mindful of your financial goals. Instead of being tempted to splurge, take a step back and think about how it fits into your budget.

Identify triggers

Identifying triggers is an important part of avoiding emotional spending. Make sure to pay attention to what makes you want to spend money impulsively and work to avoid those triggers. Find healthier ways to cope with emotions, like spending time with friends, going for a walk, or finding a creative outlet.

When it comes to avoiding emotional spending, it is important to be mindful of your spending habits and be honest with yourself. Ask yourself questions like, “Do I really need this?” and “Can I afford this?” and make sure that you are making conscious decisions with your money.

Research alternatives

When researching alternatives for emotional spending, take the time to compare prices and find the best value for your money. Consider shopping around, asking for discounts, or looking for coupons. Doing your research can help you make an informed decision and save you money.

One way to avoid emotional spending is to take a step back, take a deep breath, and evaluate the situation objectively. Think about whether the purchase is necessary and how it will impact your budget and financial goals.

Find support network

Finding a support network of friends, family, or even online communities will help you stay accountable and provide encouragement when you feel like emotional spending. Talking openly about your experiences will help you stay on track and find solutions to prevent emotional spending.

When it comes to avoiding emotional spending, it’s important to stay mindful of your spending habits and be aware of any triggers that may lead to an impulse purchase. Before making any purchase, take a few moments to pause and weigh the pros and cons to ensure it’s something you truly need and can afford.

Reward self responsibly.

It’s important to be mindful of how you reward yourself. Instead of emotional spending, find ways to reward yourself that don’t involve spending money, such as taking a walk, reading a book, or spending time with friends.